A fair market valuation, also known as a comparative market analysis (CMA), is an important process that real estate agents use to determine the value of a property. This valuation helps sellers set an appropriate listing price and assists buyers in making informed offers. Here are the essential steps involved in conducting a fair market valuation:

Collect Property Information:

The first step is to gather comprehensive information about the property being evaluated. This includes details such as the property’s address, size, layout, age, condition, and any unique features.

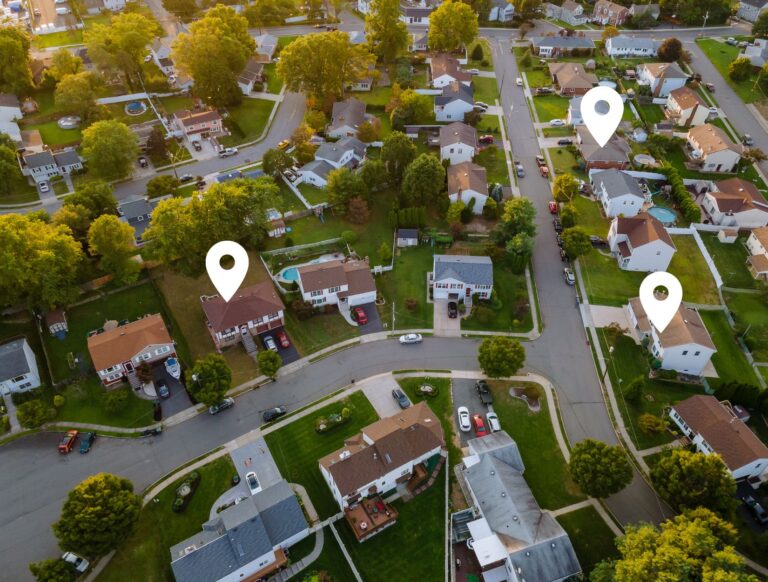

Research Comparable Sales (Comps):

Real estate agents research recently sold properties in the same neighborhood or a similar location with characteristics that closely match the subject property. These are known as “comparable sales” or “comps.”

Select Comparable Properties:

Agents select a group of comps that are as similar as possible to the subject property in terms of size, features, age, and condition. Ideally, these comps should have sold within the last few months.

Adjustment for Differences:

Not all comps will be identical to the subject property. Agents make adjustments to the sale prices of the comps to account for differences. For example, if a comp has an extra bedroom, the agent might adjust its price downward to compensate for the subject property’s smaller size.

Calculate the Median Price:

After making adjustments, the agent calculates the median sale price of the selected comps. The median is used because it’s less affected by outliers than the average.

Consider Market Conditions:

Agents consider the current state of the real estate market, including factors like supply and demand, interest rates, and economic conditions. Market conditions can significantly impact a property’s value.

Assess Property-Specific Factors:

In addition to comps and market conditions, agents also consider property-specific factors, such as its curb appeal, upgrades, and any issues that might affect its value.

Final Valuation and Report:

Based on the gathered data, adjustments, and market analysis, the real estate agent determines a fair market value for the subject property. They then provide a detailed report to their client (usually the property seller or buyer) that includes their findings and the recommended listing or offer price.

Discuss with the Client:

The agent reviews the valuation report with the client and explains how they arrived at the suggested price. This discussion helps the client make informed decisions about pricing strategy.

Monitor Market Changes:

The real estate market can change rapidly. Agents may need to adjust their valuation if market conditions or the availability of new comps shift significantly.

Market the Property or Make an Offer:

Depending on whether the client is a seller or buyer, the agent helps them list the property at the recommended price or make an informed offer based on the valuation.

Negotiate and Close the Deal:

The agent continues to work with their client throughout the negotiation process, ensuring the best possible outcome, and assists in closing the real estate transaction.

It’s important to note that fair market valuations are not appraisals, which are typically conducted by licensed appraisers and follow a more standardized and stringent process. However, a well-prepared CMA can be a valuable tool for buyers and sellers in the real estate market.